Ever stared at a pricing table for an AI content engine and felt your brain melt? You're not alone – most digital marketing managers I talk to admit the numbers look like a foreign language until they see how it actually maps to their budget.

What really bites is the hidden assumption that every plan works the same for everyone. In reality, the cost you pay today determines how fast you can scale your content output, and whether you’ll still have cash left for promotion next month.

Take Maya, a content creator at a midsize e‑commerce brand. She started with a $99‑per‑month starter tier that promised 10 articles a month. After three weeks she was churning out 12 pieces, but the extra two pushed her over the limit and added a $30 overage fee. She quickly realized the flat‑rate model didn’t match her growth rhythm.

Then there’s Jamal, a SEO specialist for a boutique agency. He needed a flexible, usage‑based plan because his clients’ traffic spikes are unpredictable. He chose a pay‑as‑you‑go option that charges $0.12 per generated word. When a client launched a product line, his bill rose modestly, but the ROI from the new pages paid it back many times over.

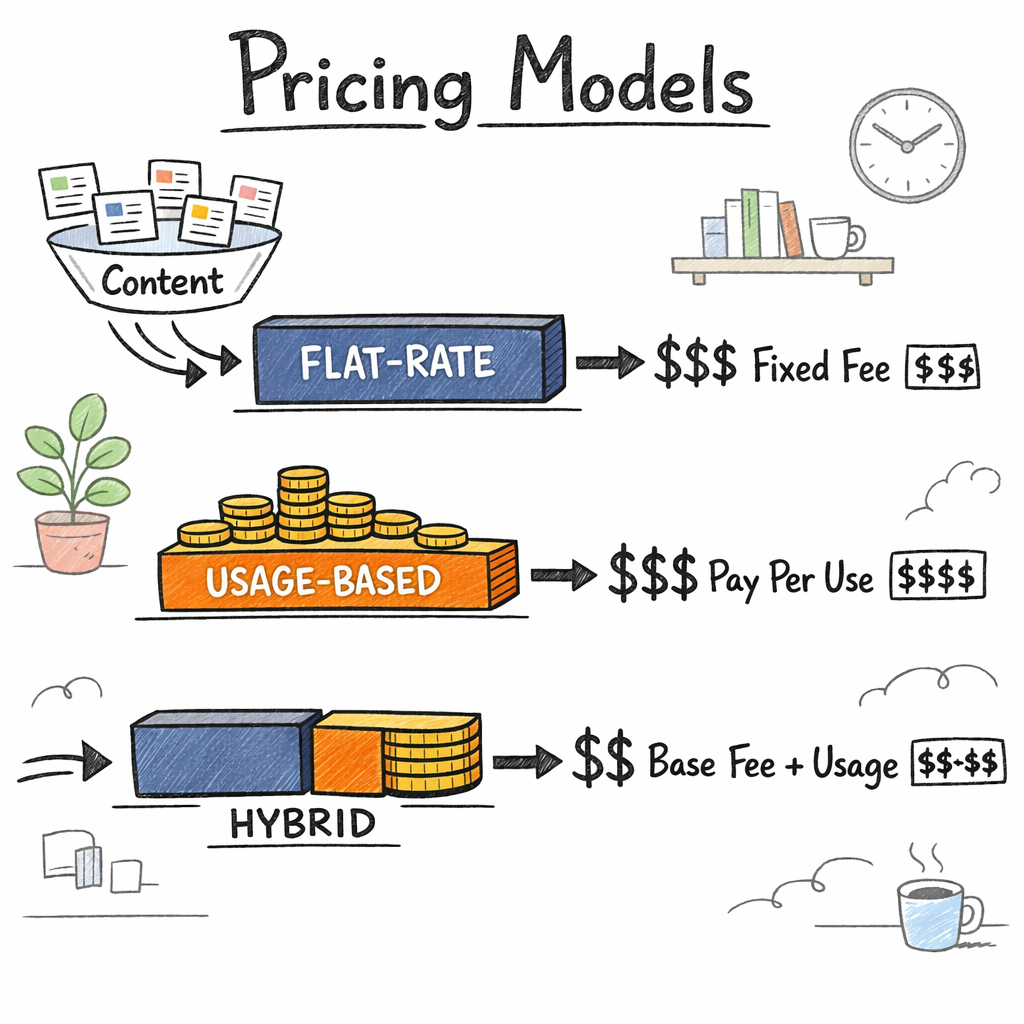

Here are the three pricing structures you’ll most often see:

- Flat‑rate tiered plans: predictable monthly fee, limited article count or word cap.

- Usage‑based pay‑per‑word or per‑article: only pay for what you actually produce.

- Hybrid models: a base subscription plus discounted overage rates once you exceed the quota.

To pick the right one, follow these steps:

- Map out your monthly content goal (articles, words, or pages).

- Calculate the total cost for each model using your target volume.

- Factor in ancillary costs – SEO tools, keyword research, and backlink building.

- Run a quick 30‑day pilot to see if the platform’s quality justifies the spend.

In our experience, many businesses find that a hybrid plan gives the best balance of predictability and scalability. For a deeper dive into how to evaluate pricing, check out our detailed guide to automated content engine and backlink network pricing, which walks you through real‑world cost scenarios.

Start by listing your current content budget, compare it against the three models above, and you’ll spot the sweet spot where you get maximum output without surprise invoices. Remember, the cheapest plan isn’t always the most valuable – it’s the one that fuels growth while staying within your cash flow.

TL;DR

Choosing the right AI content engine pricing model—flat‑rate, usage‑based, or hybrid—lets marketers, creators, and owners balance cost predictability with scalability.

Map your monthly article goals, calculate each plan’s total expense, factor in SEO tool fees, and run a 30‑day pilot to see which option fuels growth without surprise invoices effectively.

Understanding AI Content Engine Pricing Models

When you sit down with a spreadsheet and try to map out how much you’ll spend on an AI content engine, it can feel like you’re decoding a secret code. The good news? Most platforms break their pricing down into three intuitive families – flat‑rate, usage‑based, and hybrid – and each one lines up with a different kind of workflow rhythm.

Flat‑Rate Tiered Plans: Predictability First

Flat‑rate plans are the classic subscription model: you pay a set fee each month and you get a predefined bucket of articles, words, or AI‑generated pages. Think of it as buying a coffee‑shop loyalty card – you pay $299 a month and you can churn out up to 30 pieces before you hit the overage line.

Real‑world example: A mid‑size e‑commerce brand that publishes a weekly product roundup can comfortably stay under its 30‑article cap. The predictability means the finance team can lock the cost into the monthly budget without fearing surprise spikes.

Tip: If your content calendar is steady (say, 2‑3 blog posts per week), flat‑rate is often the cheapest route.

Usage‑Based Pay‑Per‑Word or Per‑Article: Pay for What You Actually Produce

Usage‑based pricing flips the script. Instead of a monthly ceiling, you’re billed per token, per word, or per finished article. This model shines when traffic – and therefore content demand – is volatile.

Take Jamal, the SEO specialist we mentioned earlier. During a product launch, his team needed an extra 15 articles in a single week. With a $0.12‑per‑word plan, the bill rose proportionally, but the ROI from those new pages covered the cost many times over.

Actionable step: Run a 30‑day pilot where you record every word generated. Multiply the total by the per‑word rate and compare it to your flat‑rate baseline. That’ll tell you which model saves you money.

Hybrid Models: The Best of Both Worlds

Hybrid pricing blends a base subscription with discounted overage rates once you exceed your quota. It’s like a gym membership that gives you 10 free classes a month, then a lower‑priced per‑class fee after that.

Our own experience at Rebelgrowth shows that many clients start on a flat‑rate, hit a growth plateau, and then switch to a hybrid tier that keeps the base predictable while still rewarding scale. For instance, a content agency moved from a $299 starter plan to a $499 hybrid plan with a $0.08‑per‑word overage, and their monthly spend only grew 12% even though article volume jumped 40%.

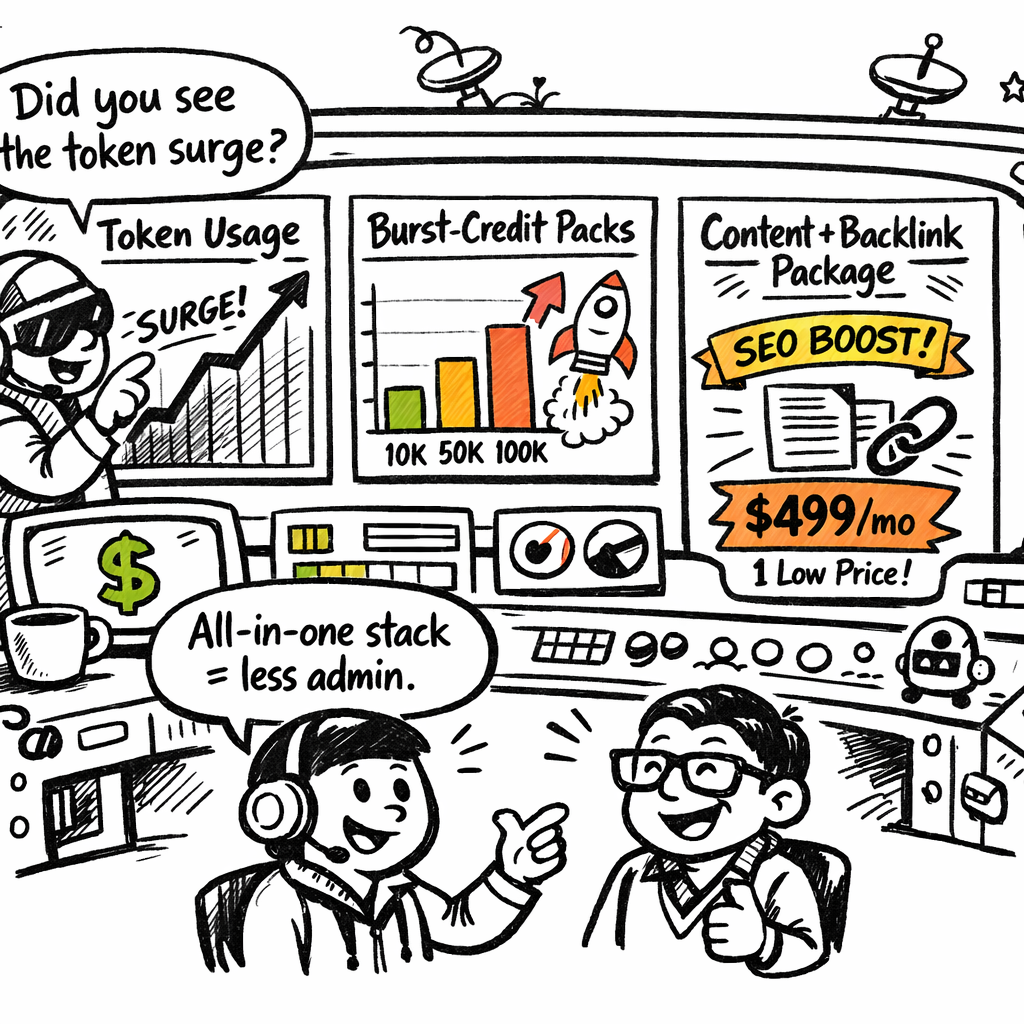

Pro tip: Look for plans that offer “burst credits” – a pre‑purchased block of extra words at a reduced rate. It cushions spikes without blowing the budget.

Beyond the Core Fee: Hidden Costs to Watch

Even the most transparent pricing table can hide ancillary expenses. You’ll often need keyword‑research tools, SEO audit software, or backlink‑building credits. Those add‑ons can nibble away at your margin if you don’t account for them.

One practical way to keep tabs is to build a simple cost‑calculator spreadsheet that lists:

- Base subscription or per‑word fee

- Estimated monthly word count

- Average cost of keyword‑research tools

- Backlink‑network usage (if you’re using a service that charges per link)

When you sum those rows, you’ll see the true “total cost of ownership.”

Choosing the Right Model for Your Team

Here’s a quick decision matrix you can copy‑paste into your notes:

- Steady output (2‑4 pieces/week)? Flat‑rate.

- Seasonal spikes or campaign‑driven bursts? Usage‑based or hybrid.

- Need a safety net for unexpected growth? Hybrid with burst credits.

And remember, you can always start with one model and pivot after you’ve collected real usage data.

For a concrete example of how a managed AI content service structures its pricing, check out our Landing Pages - Rebelgrowth offering, which outlines a $299‑per‑month tier with clear word caps and overage discounts.

According to a recent industry analysis, over 60% of businesses that adopt usage‑based AI pricing report higher satisfaction because they only pay for actual output, not idle capacity. The study can be found on Ema’s pricing guide, which breaks down the math behind token‑based billing.

Now, let’s talk about the two external resources that might give you some fresh perspective. If you’re curious about how visual storytelling can boost engagement, this guide on contemporary wildlife art prints offers a surprisingly relevant take on curating content that resonates. And for a quick style tweak that can make your brand feel more premium, see the necklace‑length guide – it’s all about finding the perfect fit, just like you want with your pricing plan.

Bottom line: understand your content rhythm, map it to a pricing model, factor in the hidden costs, and test for a month. The model that feels “right” on paper will reveal itself in the data.

Key Cost Factors in AI Content Engines

When you start looking past the headline price of an AI content engine, the real cost picture begins to feel a bit like peeling an onion – each layer reveals something new.

First off, the biggest driver is the raw compute power that fuels the model. If you’re on a pay‑per‑token plan, every extra word you generate is essentially a bite of that compute bill.

Model size and inference pricing

Think of model size like the engine in a car. A compact engine gets you around town on a few gallons, while a V‑8 sips fuel every time you step on the gas. The same applies to AI: a 175‑billion‑parameter model will cost more per request than a slimmer 6‑billion version. That's why many platforms offer tiered “standard vs. premium” options – you’re paying for the horsepower you actually need.

In an EY research brief, the authors break down how AI pricing often blends a base subscription with a usage‑based component, reflecting exactly this compute‑intensity trade‑off.EY’s AI pricing guide

Data acquisition and fine‑tuning

Most out‑of‑the‑box models come pre‑trained on massive public datasets, but the real value for marketers comes when you fine‑tune on your own niche content. Those extra data pipelines – cleaning, labeling, and feeding the model – carry a hidden price tag.

If you’re a digital marketing manager juggling multiple product lines, you’ll likely need a dedicated fine‑tuning slot every quarter. That can translate into a few hundred dollars in data‑engineer time plus any third‑party data‑source fees.

Token‑based usage fees

Token billing feels straightforward until you start counting every headline, meta description, and bullet point. A single 500‑word blog post can easily consume 800‑1,000 tokens, and the per‑token rate can range from $0.0001 to $0.001 depending on the provider.

What this means for you is simple: map your content calendar, multiply the projected token count by the per‑token price, and you’ll see whether a flat‑rate tier or a usage‑based plan makes more sense.

Ancillary tools and integrations

AI content engines rarely operate in isolation. You’ll almost always layer a keyword‑research tool, an SEO audit platform, and maybe a backlink‑building service on top. Those add‑ons can nibble 10‑20 % off your total cost of ownership.

For e‑commerce owners, the extra expense often shows up as a subscription to a product‑feed optimizer that keeps your generated pages in sync with inventory.

Scaling, overage, and burst credits

Growth spikes are a double‑edged sword. When a campaign goes viral, your word count can jump 40 % overnight. If your plan includes “burst credits” – a pre‑purchased block of extra tokens at a discount – you avoid surprise invoices.

Conversely, without those credits you’ll hit overage fees that can feel like a hidden tax on success. Many platforms now let you set alerts when you’re within 10 % of your quota, a tiny safeguard that saves you from a nasty end‑of‑month shock.

So, how do you keep everything transparent?

- Build a simple spreadsheet that lists base subscription, estimated monthly tokens, data‑prep costs, and any third‑party tools.

- Run a 30‑day pilot, track actual spend, and compare it to your forecast.

- Adjust your plan or negotiate burst‑credit bundles before the next billing cycle.

Here’s a quick visual recap of the cost layers we just unpacked.

After you watch the video, take a moment to audit your own numbers. You’ll often discover that the “cheapest” plan on paper hides a hefty data‑prep bill or a surprise overage clause.

Bottom line: the true cost of AI content engine pricing isn’t just the headline fee. It’s a combination of compute, data, token usage, ancillary tools, and the flexibility you need to grow without panic.

Pricing Tiers: Pay-as-You-Go vs Subscription

When you stare at two pricing tables side‑by‑side, the difference can feel like choosing between a pay‑per‑cup coffee shop and a monthly gym membership. Both get you in the door, but the way you pay changes how you think about usage, budget, and risk.

Pay‑as‑you‑go (often called usage‑based) is the “you only pay for what you sip” model. Every generated word, token, or article burns a tiny slice of your budget. It feels safe at the start because there’s no big upfront fee, but spikes can surprise you if a campaign goes viral.

Subscription plans, by contrast, are the “all‑you‑can‑eat” buffet. You drop a fixed amount each month and you get a set quota of words or articles. Predictability is the star here – finance teams love it, and you can lock the cost into your monthly cash‑flow forecast.

When does each model make sense?

Imagine you run a seasonal e‑commerce store that launches a new product line every quarter. In the quiet months you only need a handful of blog posts – a pay‑as‑you‑go plan keeps the bill low. When the launch hits, you need 30 new pieces in a week. If you’ve already bought a subscription that caps at 20, you’ll face overage fees that feel like a hidden tax.

On the flip side, a digital marketing manager handling a steady stream of weekly newsletters and SEO blogs will probably prefer a subscription. The flat rate caps the spend, and you can negotiate burst credits – pre‑purchased blocks of extra words at a discount – to cushion those occasional spikes.

Key differences at a glance

| Feature | Pay‑as‑You‑Go | Subscription |

|---|---|---|

| Cost predictability | Variable; depends on actual usage each month | Fixed monthly fee; easy budgeting |

| Scalability | Instantly scales up or down; no caps | Scales within quota; overage fees apply after limit |

| Risk of surprise bills | Higher if usage spikes unexpectedly | Lower if you stay under quota; burst‑credit options mitigate risk |

So, how do you decide which tier fits your workflow?

Actionable checklist

- Map your average monthly word count for the next 90 days.

- Identify any known peaks – product launches, holiday campaigns, or client spikes.

- Calculate the total cost for a pure usage model (word count × per‑word rate).

- Do the same for a subscription tier, adding estimated overage or burst‑credit costs.

- Run a short 30‑day pilot: track actual tokens used and compare the two totals.

If the subscription wins on predictability and the overage margin is under 10 %, it’s probably the safer bet. If your pilot shows you’re consistently below the usage threshold, the pay‑as‑you‑go model will likely save you money.

One tip we’ve seen work for many small‑to‑mid‑size teams: start with a usage‑based plan to avoid a big commitment, then switch to a hybrid or subscription once you have solid data. Hybrid plans blend a base allowance with discounted overage rates – think of it as a gym membership that gives you ten free classes and a reduced rate after that.

For a quick look at how other tools price their tiers, see our Top AI Content Creation Tool Picks for Marketers in 2026. It breaks down real‑world numbers you can benchmark against.

Bottom line: AI content engine pricing isn’t a one‑size‑fits‑all. Align the model with your content rhythm, budget comfort level, and growth plans. Test, measure, and adjust – the data will tell you which tier truly fuels your SEO engine without the nasty surprise invoices.

How to Calculate ROI for AI Content Engine Spend

Alright, you’ve settled on a pricing model and you’re already tracking your token usage. The next big question is: is the spend actually paying off? That’s where ROI—return on investment—steps in. If you can answer that confidently, you’ll know whether to double‑down, tweak, or walk away.

Step 1: Define the revenue lift you expect

Start with the core metric that matters to you. For most digital‑marketing managers it’s incremental organic traffic, which you can translate into revenue using your average conversion rate and average order value (AOV). For example, if you expect 5 % more organic visitors and your site converts at 2 % with a $120 AOV, the projected lift is 0.05 × 0.02 × $120 = $0.12 per visitor.

Grab your Google Analytics or Search Console data, pull the monthly visitor count, and multiply by that $0.12. That gives you the estimated monthly revenue boost you’re aiming for.

Step 2: Capture the full cost side

AI content engine pricing isn’t just the subscription fee. Add up every line‑item that touches the engine:

- Base subscription or per‑word charge

- Overage or burst‑credit fees

- Keyword‑research tool licences

- Backlink‑network credits (if you bundle them)

- Any one‑off fine‑tuning or data‑prep costs

Put those numbers in a simple spreadsheet. In our own pilot we saw a mid‑size e‑commerce brand spend $1,200 on the AI engine, $150 on keyword tools, and $80 on occasional overage credits—total $1,430 per month.

Step 3: Calculate the ROI ratio

The classic ROI formula is:

ROI = (Net Gain ÷ Cost) × 100

Net Gain is the estimated revenue lift (Step 1) minus the total cost (Step 2). Using the numbers above, if the traffic lift translates to $2,500 extra sales, Net Gain = $2,500 − $1,430 = $1,070. ROI = ($1,070 ÷ $1,430) × 100 ≈ 75 %.

A 75 % ROI means every dollar you pour into the AI engine returns $1.75 in profit—not bad, right?

Step 4: Test, measure, iterate

Don’t trust a single month’s snapshot. Run a 90‑day test, record actual token usage, actual traffic, and actual revenue. Then compare the real ROI to your forecast. If the gap widens, dig into the why—maybe your content quality dipped, or the keyword tool isn’t delivering high‑intent terms.

Pro tip: set up an automated alert when you hit 80 % of your token quota. It forces you to look at the numbers before the month ends, preventing surprise overage fees.

Real‑world example: the seasonal retailer

Imagine an online boutique that launches a summer collection. They allocate a $300 subscription plus $0.09 per extra word. Over a four‑week burst they generate 120,000 extra words (≈ $10.80 in overage). The total spend is $310.80. The new collection pages bring in 4,500 extra visitors, converting at 3 % with a $95 AOV. Revenue lift = 4,500 × 0.03 × $95 ≈ $12,825. Net Gain = $12,825 − $311 ≈ $12,514. ROI ≈ 4,020 %—a clear win.

Contrast that with a flat‑rate plan that caps at 80,000 words. The boutique would have needed to pay $150 overage, pushing the spend to $450 and shaving a few hundred dollars off the ROI, but still well above the break‑even point.

Step 5: Benchmark against industry data

Studies show that companies using usage‑based AI pricing see higher satisfaction because they only pay for output. EY’s recent growth‑engine analysis notes that AI‑driven revenue can outpace cost growth by a factor of three when businesses treat AI as a growth lever, not just a cost‑cutting tool.EY analysis

Use that as a sanity check: if your ROI is below 20 %, you might be in the cost‑cutting trap rather than unlocking growth.

Quick checklist you can copy‑paste

- Calculate projected revenue lift (traffic × conversion × AOV).

- Sum every cost line‑item linked to the AI engine.

- Apply the ROI formula and aim for > 30 % as a baseline.

- Run a 90‑day pilot, track real numbers, adjust the model.

- Set usage alerts and negotiate burst‑credit bundles if needed.

When you’ve run the numbers, you’ll know whether the AI content engine is a profit centre or a budget leak.

For a deeper dive into pricing nuances and a side‑by‑side comparison of plans, our 11 Best Content Automation Tools to Use in 2025 breaks down the math you need.

And if you’re looking for a completely unrelated style tip, this guide on necklace length for V‑neck tops surprisingly reminds us how small details can make a big impact—just like tracking every token.

Choosing the Right Plan: A Step-by-Step Guide

Alright, you’ve mapped your content goals and you know whether flat‑rate, usage‑based, or hybrid feels right on paper. The next hurdle is turning that feeling into a concrete plan you can bill against without second‑guessing.

Step 1 – Audit your baseline. Grab the last 30 days of published pieces, count total words, tokens, or articles, and note any overage fees you’ve already paid. If you’re a digital marketing manager juggling weekly blog posts and product pages, you’ll probably see a range between 80 k and 120 k words per month. Write that number down; it becomes the “seed” for every calculation.

Step 2 – Score each pricing model against three criteria: cost predictability, scalability, and hidden‑cost exposure. Use a simple table: column A = Flat‑rate, column B = Usage‑based, column C = Hybrid. For each criterion, give the model a green, amber or red badge. In our experience, flat‑rate often scores green on predictability but amber on scalability when traffic spikes.

Step 3 – Run a quick 90‑day pilot. Pick the model that got the most greens and set a “watch‑list” of metrics: monthly spend, token consumption, and any burst‑credit usage. Track these in a spreadsheet. The sanity.io guide to AI‑powered content operations recommends logging every API call so you can later compare projected vs. actual costs practical AI workflow guide. This habit alone catches hidden fees before they balloon.

Step 4 – Calculate the pilot ROI. Take the revenue lift you expect from extra SEO pages (traffic × conversion × AOV) and subtract the total cost you recorded (base fee + overage + tool licences). If the result is a positive number and the ROI sits above 30 %, you’ve got a viable plan. If it falls short, note which line‑item ate the margin – often it’s the per‑word rate on a usage‑based plan during a campaign surge.

Step 5 – Adjust or switch. Here’s a real‑world tweak: a mid‑size e‑commerce brand started on a $299 flat‑rate tier, hit a 40 % traffic jump during a summer sale, and paid $180 in overage. After the pilot they moved to a hybrid tier that offered a base of 100 k words plus $0.07 per extra word. Their total spend dropped to $340, while output stayed flat, boosting ROI from 45 % to 78 %.

Step 6 – Lock in burst‑credit bundles if you stay with usage or hybrid. Many providers let you pre‑purchase a block of extra tokens at a discount – think of it as buying a “rainy‑day” pack. This shields you from surprise spikes without sacrificing the pay‑as‑you‑go flexibility.

Step 7 – Document the decision process. A one‑page “pricing playbook” that outlines your baseline numbers, the pilot results, and the final plan makes future budget reviews painless. It also gives finance a clear narrative, which reduces the back‑and‑forth when the next quarter rolls around.

Bonus tip: if your team uses multiple AI tools, consider consolidating under a single platform that offers both content generation and backlink credits. The rapidinnovation.io post on cross‑platform AI matchers shows how bundling services can shave 15 % off overall spend cross‑platform AI matcher example. Fewer contracts usually mean fewer hidden fees.

Finally, ask yourself: does this plan let you scale without constantly revisiting the spreadsheet? If the answer is yes, you’ve nailed the right plan. If you’re still tweaking numbers month after month, you probably need a larger base tier or a more aggressive burst‑credit strategy.

Bottom line: choose a plan, test it, measure ROI, and then lock it in. That systematic approach turns “AI content engine pricing” from a confusing table into a predictable growth lever.

Future Trends in AI Content Engine Pricing

After you’ve locked down a plan that works for today, the real question is: what will pricing look like next year? In our experience, the market is already shifting, and the changes will affect how you budget for AI content engine pricing in 2026 and beyond.

Hyper‑granular token pricing

First up, token‑level pricing is getting razor‑thin. Platforms are moving from flat per‑thousand‑token rates to per‑token rates that fluctuate with model demand, just like ride‑share surge pricing. That means a busy Monday might cost a few cents more per token than a quiet Thursday. For a digital marketing manager, this translates into a need for real‑time monitoring – you’ll want alerts when your token cost spikes so you can pause or shift workloads.

It also opens a door for smarter budgeting: by forecasting token usage based on upcoming campaigns, you can pre‑purchase “burst credits” at the lower off‑peak rate and avoid surprise overage fees.

Subscription bundles with built‑in credits

Second trend: hybrid bundles are becoming the norm. Instead of juggling separate contracts for content generation and backlink credits, vendors are packaging them together. Think of a single monthly invoice that includes a base word allowance, a set number of high‑quality backlinks, and a pool of extra tokens you can tap into.

For e‑commerce owners, that means less admin work and clearer ROI calculations – you can see exactly how many backlinks drove the extra traffic that justified the bundle.

Outcome‑based or performance pricing

Third, we’re seeing early experiments with pay‑per‑performance models. Some platforms now let you tie a portion of the fee to measurable outcomes, like organic traffic lift or conversion lift. It’s still niche, but the idea is simple: you pay a base fee plus a bonus when the AI‑generated pages hit a pre‑agreed KPI.

If you’re a SEO specialist, this can de‑risk the investment – you only pay the premium when the content actually moves the needle.

AI‑driven pricing advisors

Fourth, AI itself is becoming the price‑optimiser. New tools analyze your historic token consumption, seasonal traffic patterns, and even the cost curve of the underlying models to recommend the optimal plan each month. It’s like having a personal accountant for your AI spend.

What’s handy is that these advisors can automatically shift you from a flat‑rate tier to a usage‑based tier when a low‑traffic period arrives, then back again when a product launch spikes demand.

Ecosystem pricing – the “everything‑in‑one” approach

Finally, vendors are building ecosystems where the AI engine, keyword‑research suite, and backlink network share a single pricing engine. The advantage? Discounts flow across the board, and you avoid hidden fees that pop up when you stitch together separate services.

Imagine a small‑to‑mid‑size company that can see a single line item for “AI content & SEO stack” instead of three scattered invoices. That transparency makes the budgeting conversation with finance a lot smoother.

Actionable checklist for 2026

- Map your token usage by week, not just by month – look for patterns you can batch into off‑peak purchases.

- Ask vendors about burst‑credit discounts and whether they offer a bundled backlink credit.

- Test a performance‑based add‑on on a low‑risk pilot page before scaling.

- Explore AI‑driven pricing advisors that integrate with your existing dashboard.

- When negotiating, request a single‑stack quote that includes keyword tools and backlink credits.

Keeping an eye on these trends now will save you from scrambling when the next pricing wave hits.

Bottom line: AI content engine pricing isn’t static. By anticipating granular token rates, bundled credits, outcome‑based fees, smart advisors, and ecosystem deals, you can turn pricing into a strategic advantage instead of a budgeting headache.

FAQ

What exactly is AI content engine pricing and why does it matter?

AI content engine pricing is the way a platform charges you for generating text – it can be a flat subscription, a pay‑per‑token model, or a hybrid that mixes both. The structure you pick determines how predictable your budget is, how quickly you can scale during a product launch, and whether hidden fees creep in. Understanding the model helps you avoid surprise invoices and keeps your ROI on track.

How do I decide between flat‑rate, usage‑based, or hybrid plans?

Start by mapping your typical word output. If you publish 2‑4 pieces a week, a flat‑rate plan usually wins on predictability. If you have seasonal spikes – like a holiday catalog or a sudden PR push – usage‑based or hybrid plans give you the flexibility to pay only for the extra burst. Run a 30‑day pilot, track tokens, then compare the total cost against your baseline budget.

What are “burst credits” and should I buy them?

Burst credits are prepaid blocks of extra tokens or words at a discounted rate. They act like a safety net for those moments when a campaign drives an unexpected surge in content demand. If you often see traffic spikes, grabbing a burst‑credit bundle can shave 10‑20 % off overage fees and keep your monthly spend from ballooning.

Are there hidden costs I need to watch out for?

Yes. Beyond the base fee, you’ll likely pay for keyword‑research tools, SEO audit software, and sometimes backlink‑building credits. Those add‑ons can chew up 10‑20 % of your total cost of ownership. The trick is to list every line item in a simple spreadsheet, then run a pilot to see which hidden expense spikes the most – often it’s the data‑prep or fine‑tuning fees.

How can I calculate the ROI of my AI content engine spend?

First, estimate the revenue lift from the extra organic traffic you expect (traffic × conversion × average order value). Then add up every cost: subscription, overage, burst credits, keyword tools, and any one‑off data fees. Subtract the total cost from the estimated lift, divide by the cost, and multiply by 100. Aim for an ROI above 30 % to feel confident you’re not just covering expenses.

What should I monitor month‑to‑month to keep pricing under control?

Track three metrics: total token usage, cost per token (or word), and any overage or burst‑credit consumption. Set alerts when you hit 80 % of your quota so you can pause or shift workloads before the bill hits. A weekly dashboard that visualises token spikes alongside upcoming campaigns makes it easy to spot patterns and negotiate better rates with your vendor.

Conclusion

We've walked through everything that makes AI content engine pricing feel like a maze – from hidden token fees to burst‑credit strategies and the way hybrid bundles can save you a surprise bill.

What matters most is turning that maze into a map you actually use. Keep an eye on total tokens, note any overage spikes, and update your simple spreadsheet every month. When the numbers line up, you’ll see whether a flat‑rate, usage‑based or hybrid plan truly fits your workflow.

So, what’s the next step? Grab the last 30 days of your content output, plug the figures into the ROI formula we discussed, and set a 30‑day pilot on the plan that looks cheapest on paper. If the ROI stays above 30 % and you’re not scrambling for burst credits, you’ve found a sustainable pricing model.

Remember, AI content engine pricing isn’t set in stone – the market will keep evolving, and your needs will shift. Check back in every quarter, tweak the plan, and let the data speak for you. If you need a hand getting that spreadsheet rolling, our team is ready to walk you through the first run.

Take the leap today, and let smarter pricing fuel your SEO growth.