Conducting a competitor analysis is all about figuring out who you're really up against, what they're doing, and how you can do it better. It’s a strategic deep dive that takes you from guessing what works to knowing what works—and using that knowledge to sharpen your own game plan.

Why Competitor Analysis Matters More Than Ever

In today's crowded markets, just having a great product or service is rarely enough. You have to understand the entire ecosystem you're operating in.

Think of competitor analysis as a continuous process, not a one-and-done task. It's your early warning system for market shifts and your roadmap for spotting untapped opportunities. Getting this right is what separates businesses that lead from those that just follow.

This isn't just a hunch; the numbers back it up. The global Competitor Analysis Evaluation market hit $4.32 billion in 2021 and is on track to reach $6.6 billion by 2025. This explosive growth sends a clear message: companies that invest in understanding their rivals are the ones best positioned to win.

Understanding Your Competitive Landscape

Before you can analyze anyone, you need a clear picture of who you're actually competing with. It's almost never just one group of companies. They typically fall into three distinct categories, and knowing the difference is crucial for a complete analysis.

To get a full 360-degree view, you need to map out every type of competitor that could potentially steal a customer's attention or budget. This ensures your analysis is comprehensive from the start.

| Competitor Type | What They Are | Example For a Local Coffee Shop |

|---|---|---|

| Direct | Businesses offering a nearly identical product to the same audience. The most obvious rivals. | The Starbucks down the street or another independent cafe in the neighborhood. |

| Indirect | Businesses solving the same core problem but with a different solution. | A local tea house, a smoothie bar, or even a grocery store selling high-end coffee beans. |

| Replacement | Businesses offering something completely different that a customer might spend their money on instead. | A fancy energy drink brand or a subscription for at-home espresso pods. |

By mapping out all three types, you get a much richer, more realistic view of the choices your customers are actually making. This is the foundation of a resilient strategy.

A common misstep is focusing only on direct competitors. This leaves you wide open to being blindsided by an indirect player or a new replacement solution that swoops in and steals market share.

Failing to see these different threat levels is a classic mistake. I've seen countless businesses obsess over their head-to-head rivals while a smaller, indirect competitor quietly eats their lunch.

For more on building a solid marketing foundation, the folks over at https://rebelgrowth.com/blog share some fantastic insights. Getting this landscape right from the beginning ensures your analysis is sharp, focused, and uncovers the kind of insights that actually move the needle.

How to Find Your Real Competitors

Before you can analyze anything, you need to know who you’re actually up against. And spoiler alert: it’s almost never who you think.

Your biggest rivals aren’t just the companies with a similar logo and feature list. They’re anyone competing for your customer’s attention—and their budget. Getting past the usual suspects is the first real step.

A great place to start digging is the search engine results page (SERP). But don't just search for your own brand name. The real insights come from the top 10-15 non-branded keywords your ideal customer would type into Google.

Think about what your customer is actually trying to solve. They’re not searching for you, they're searching for an answer. Terms like "best project management software for small teams" or "how to improve team collaboration" are what you're looking for. The sites that show up again and again for these queries are your true SEO competitors. They're fighting you for the exact same digital real estate.

Uncovering Competitors in the Wild

Search results are just one piece of the puzzle. To get the full picture, you need to listen in on the conversations your potential customers are already having. You need to go where they go for advice.

These online hangouts offer unfiltered, honest opinions about the alternatives people are really considering.

- Social Media & Forums: Places like Reddit, Quora, and niche industry forums are absolute goldmines. Look for threads where people ask, "What tool do you use for X?" or "I'm looking for an alternative to Y." The answers are your competitive landscape, straight from the horse's mouth.

- Review Sites: Check out platforms like G2, Capterra, or Trustpilot. You won't just find direct competitors. Pay close attention to their "alternatives" and "comparisons" sections—they often shine a light on indirect rivals you never would have thought of.

- Your Own Customer Feedback: Listen to your sales calls and read your support tickets. When a lead says they're also looking at another company, or a customer leaves for a different solution, that’s not just feedback. You've just identified a competitor who is actively winning deals against you.

The goal isn't to create a massive, overwhelming list. It's about understanding the context—why your brand is being compared to others in the first place. This is what separates a routine analysis from a game-changing one.

Categorizing for Clarity and Focus

Once you have a solid list of names, the next step is to organize it. This is crucial for avoiding analysis paralysis. A simple framework helps you prioritize your efforts on the businesses that pose the biggest threat or offer the best learning opportunities.

Breaking it down makes your entire analysis more manageable and, more importantly, actionable.

| Competitor Category | Key Characteristic | Example for a Social Media Scheduling Tool |

|---|---|---|

| Primary Competitors | Offer a very similar product to the same target market. This is your direct competition. | Another dedicated social media scheduling platform like Buffer or Hootsuite. |

| Secondary Competitors | Offer a high-end or low-end version of your product, or sell to a slightly different audience. | A large, enterprise-level marketing suite that includes scheduling as one of many features. |

| Tertiary Competitors | Offer a related product or service that could indirectly solve the customer's problem. | A virtual assistant service that handles social media management for clients. |

Mapping your rivals this way ensures your competitive analysis stays focused on the companies that actually move the needle for your business. From here, you can decide whether to do a deep dive on your primary competitors or just keep a casual eye on your tertiary ones for any big market shifts.

Gathering Intelligence You Can Actually Use

Alright, you’ve got your list of competitors. Now the real fun begins.

This isn't about creating some massive, overwhelming spreadsheet filled with random data points that you'll never look at again. The goal here is to collect focused, actionable intelligence—the kind that truly reveals your competitor's playbook. We're going to systematically pull apart their entire digital presence, piece by piece.

To do this right, you have to know which metrics actually matter. We’ll skip the surface-level vanity numbers like follower counts and dive straight into the data that drives real strategy. Think top-performing keywords, valuable backlink sources, and their most engaging social media content.

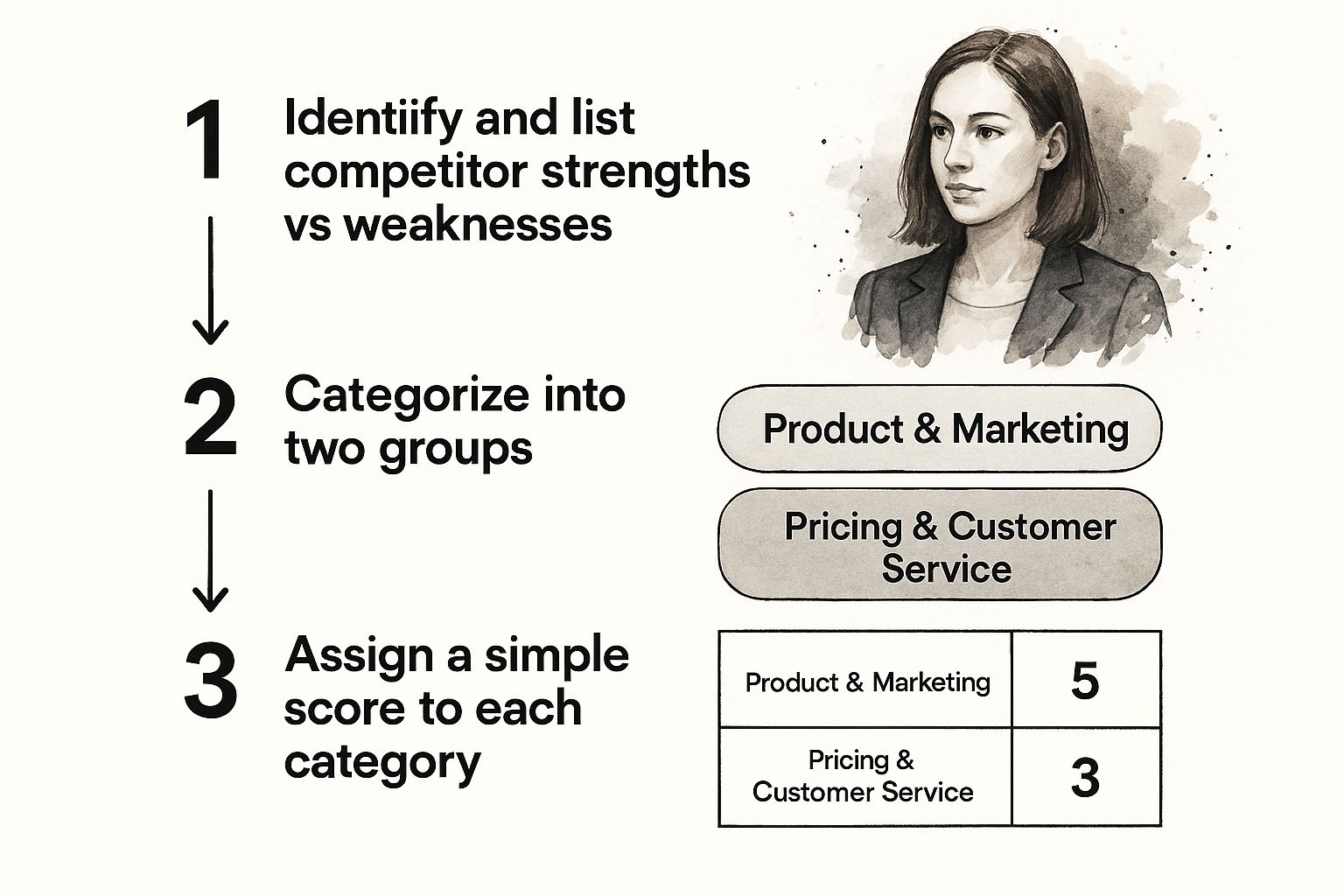

This whole process is about simplifying how you score competitors by breaking down their strengths and weaknesses into key business areas, just like in the flow below.

Think of this as a visual framework. It helps you turn a long list of observations into a scored, prioritized assessment of where you stand.

Dissecting Their Digital Footprint

To really get a handle on your rivals, you need to look at what they’re doing, not just what they're saying. This calls for a methodical review of their key marketing channels.

Your primary objective? Pinpoint their strategic soft spots and find gaps you can drive a truck through.

- SEO & Content: What keywords are actually bringing them traffic? Which topics are they known for, and more importantly, what have they completely missed? The right tools can show you their top-performing pages and the exact search terms they rank for.

- Backlink Profile: Who is linking to them? High-authority links from respected sites are gold. Identifying their best backlinks can uncover potential partnership or PR opportunities for your own brand.

- Social Media Strategy: Where do they hang out online? Which platforms are they most active on, and what kind of content gets the most love (likes, shares, comments)? This is a direct line into what resonates with your shared target audience.

This data collection part of the job is getting much easier these days. The global AI market is expected to grow at a staggering rate of 38% through 2025, and it’s completely reshaping how we gather market intelligence. SEO and marketing tools are now baking AI into their platforms to automate competitor tracking, which means better insights, faster. You can get more details about these future trends in AI competitor analysis.

The Right Tools for the Job

Trying to gather all this data by hand is a recipe for disaster. It’s nearly impossible.

The right tools, on the other hand, make the process systematic and efficient. They turn hours of frustrating guesswork into minutes of targeted analysis. Having a solid mix of free and paid options in your toolkit is the way to go.

For example, a platform like Semrush gives you a comprehensive overview of a competitor's online presence all in a single dashboard.

From a quick snapshot, you can get a solid baseline for their organic traffic, paid search spend, and backlink authority. It’s the perfect starting point for a deeper dive.

Don't just collect the data; question it. Ask why a certain page ranks number one or why a particular social post went viral. The 'why' is where strategic insights are born.

Beyond Digital Marketing

While dissecting their digital strategy is crucial, don't stop there. You need to look at the core of their business. Dig into their product offerings, see how they structure their pricing, and find out what real customers are saying about them in reviews.

- Product & Pricing: How do their features and pricing tiers stack up against yours? Are they positioning themselves as the budget-friendly option or the premium, top-shelf solution?

- Customer Reviews: What are the most common complaints you see in their negative reviews? These are direct clues to their biggest weaknesses—and your biggest opportunities.

Taking this holistic approach is what separates a good analysis from a great one. When you combine digital metrics with business fundamentals, you get the full picture. You gather intelligence that truly informs your strategy and gives you a clear path forward.

You’ve done the grunt work. Spreadsheets are filled, reports are downloaded, and you have a mountain of data sitting in front of you. This is exactly where most competitor analyses die—becoming a collection of facts instead of the spark for your next big move.

Raw data is just noise. The real skill is learning how to tune into the right frequency and turn that noise into a clear signal.

This is where the magic happens. It’s about shifting from just knowing what your competitors are doing to deeply understanding why it’s working (or not working) and how you can use that to your advantage. Think of yourself less as a data entry clerk and more as a strategist.

Your goal here is to find tangible gaps in the market, pinpoint your competitors' biggest vulnerabilities, and get ahead of trends before they become common knowledge.

The SWOT Analysis, Reimagined

A classic SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is a great framework, but it's often filled with gut feelings and assumptions. To make it truly powerful, we’re going to give it a modern, data-driven makeover.

Instead of guessing, you'll populate each quadrant with the cold, hard data you just spent hours collecting. This isn't just an academic exercise; a properly executed SWOT gives you a visual snapshot of your competitive position. It’s a powerful tool for getting your team on the same page and pushing your next initiatives forward.

Here’s a practical example to show you what I mean. Imagine you're launching a new project management SaaS and you’re trying to carve out a space in a super-crowded market.

SWOT Analysis Framework for a Fictional SaaS

See how to organize your findings with this practical example for a new project management tool.

| Category | Example Insight |

|---|---|

| Strengths | Competitor A has a massive backlink profile from top-tier tech blogs. Their domain authority is huge, giving them a serious edge in SEO. |

| Weaknesses | Customer reviews for Competitor A are brutal when it comes to their mobile app. People consistently complain about a clunky UI and poor performance. |

| Opportunities | The market is wide open for freelancers and tiny teams. Most existing tools are priced and built for mid-sized companies, leaving a clear feature and pricing gap. |

| Threats | Competitor B is pouring money into paid ads. They're driving up CPCs for key industry terms, which makes it harder and more expensive to get organic visibility. |

See how specific data points make this framework come alive? You're not guessing anymore. You’re identifying validated weak spots and genuine market openings. This structured approach helps transform a pile of data into a clear strategic roadmap.

Key Takeaway: The most powerful insights are born at the intersection of a competitor's weakness and a market opportunity. This is where you can build a truly differentiated brand.

Using the insights from the table, you could launch a marketing campaign focused on your sleek, intuitive user experience. You'd specifically target freelancers with highly optimized landing pages that convert and speak directly to their pain points.

Don’t Get Tripped Up by These Common Traps

As you start piecing everything together, it's easy to fall into a few common traps that can derail even the best data collection efforts. Timeless frameworks like Porter's Five Forces are still incredibly useful, but they need to be viewed through a modern lens. For instance, focusing only on your direct competitors is a classic mistake that leaves you vulnerable to disruption from unexpected places.

To make sure your analysis actually leads to action, watch out for these pitfalls:

- Analysis Paralysis: This is where you drown in so much data that you never actually make a decision. Give yourself a deadline and force yourself to focus on the 2-3 insights that will have the biggest strategic impact.

- Ignoring Adjacent Threats: It's easy to get tunnel vision, fixating on your direct rivals. Meanwhile, a new app or a totally different type of service could be slowly chipping away at your market from the side.

- Treating It as a One-Off Task: The market is always shifting. Your competitor analysis shouldn't be a report that collects dust in a folder. It needs to be a living document that you revisit at least quarterly to stay sharp.

By consciously avoiding these mistakes, you can turn your competitor analysis from a static report into a dynamic guide that fuels your strategy and drives real, sustainable growth.

Using Your Analysis to Build a Winning Strategy

Okay, this is where all that digging and data gathering really starts to pay off. A competitive analysis that just sits in a folder is useless. It’s a collection of facts, sure, but it's not driving growth. The real magic happens when you turn those insights into action.

The goal here is to move from simply observing what your competitors are doing to making deliberate, strategic moves. You’re using what you’ve learned to sharpen your marketing, tweak your product, and deliver a customer experience that blows theirs out of the water.

Turning Insights Into Actionable Steps

So, how do you actually translate a spreadsheet full of notes into a real plan? The most effective way I've found is to apply your findings across four key areas of your business. This gives you a systematic way to improve your position in the market.

Let's break it down:

Product Differentiation: Your analysis probably uncovered some chinks in your competitors' armor. Did you spot a recurring complaint in their customer reviews about a clunky UI or a missing feature? That’s your cue. This is a validated pain point you can solve, giving you a powerful story to tell.

Marketing Messaging: How are your rivals pitching themselves? Use what you’ve learned to craft a value proposition that stands out. If everyone is screaming about being the cheapest, you can win by focusing your messaging on superior quality, responsive support, or game-changing innovation.

Pricing Strategy: Understanding how your competitors price their products gives you crucial context for your own. Are you the budget-friendly option? The premium, white-glove service? Your analysis helps you either justify your current price point or spot an opportunity to adjust your tiers and capture a whole new market segment.

Customer Experience: A competitor's weakness in customer service is a golden opportunity. If you discovered they have slow response times or unhelpful support reps, you can build your brand around being the exact opposite. Make exceptional service a core part of your identity—it’s a massive differentiator.

Prioritizing Your Next Moves

You can't do everything at once. Trust me, I've tried. The key is to prioritize the moves that will deliver the biggest bang for your buck without burning out your team.

For this, I love a simple impact vs. effort matrix.

Just plot each potential action on a two-by-two grid. This simple visual exercise cuts through the noise and shows you exactly where to focus first.

The sweet spot is always the high-impact, low-effort quadrant. These are your quick wins—the strategic moves that can deliver immediate results and build momentum.

For example, rewriting your website's headline to directly counter a competitor's weak spot is a classic low-effort, high-impact task. On the other hand, building a major new product feature is definitely high-effort, but it could also be high-impact. This framework takes the guesswork out of the equation.

By systematically applying your competitive intelligence, you turn a one-off research project into a dynamic engine for growth.

And if you're looking to take your digital strategy even further, our free AI SEO checklist is a fantastic resource for using technology to get an edge. Grab it here: https://rebelgrowth.com/lp/ai-seo-checklist. It gives you a structured way to ensure your strategy isn't just reacting to the market, but actively shaping your place within it.

Common Questions About Competitor Analysis

Even with a clear roadmap, a few questions always seem to pop up once you get into the weeds of competitor analysis. Getting these sorted out from the jump can save you a ton of headaches and help you sidestep some common traps.

The key is to think of your analysis less like a massive, one-off project and more like a strategic habit you're building. It's all about keeping a consistent pulse on the market.

How Often Should I Run an Analysis?

Honestly, the ideal frequency really depends on your industry's pace. A super deep, comprehensive analysis is perfect to tackle annually or whenever you're staring down a major strategic shift, like a rebrand or a big product launch. This is your big-picture reset.

But you absolutely need to be keeping tabs on your primary competitors more often than that.

For fast-moving spaces like e-commerce or SaaS, a quarterly check-in is the bare minimum. For things that can change on a dime, like ad campaigns or pricing, a quick monthly glance will keep you from getting caught flat-footed.

The single biggest mistake is treating competitor analysis as a one-and-done task. The market is a living, breathing thing; your understanding of it needs to be, too.

What Are the Biggest Mistakes to Avoid?

It's shockingly easy to get lost in the data or fall into a few classic traps that completely undermine all your hard work. Just being aware of these pitfalls is half the battle.

Here are the mistakes I see trip people up most often:

- Tunnel Vision: Focusing only on your direct competitors is a classic blunder. It leaves you totally blind to an indirect or up-and-coming rival who could sneak up and disrupt your entire market from the side.

- Analysis Paralysis: This is what happens when you collect endless streams of data but never actually do anything with it. Give yourself a deadline and force yourself to pinpoint the 2-3 most critical insights you can act on right away.

- Ignoring the "Why": It’s tempting to obsess over hard numbers like traffic stats and keyword rankings. But don't forget the qualitative gold you'll find in customer reviews, brand messaging, and social media comments. This is where you find the why behind the what.

- Letting Your Ego Drive: Don't let your own assumptions about a competitor cloud your judgment. You have to let the data tell the story, even if it completely contradicts what you thought you knew about a rival's strengths or weaknesses.

Market Research vs. Competitor Analysis

People throw these two terms around like they're the same thing, but they're fundamentally different. Nailing this distinction is crucial for a focused strategy.

Think of market research as the wide-angle lens. It’s about understanding the entire landscape—your potential customers, industry trends, and the overall market size. It answers the question, "What do people want?"

Competitor analysis, on the other hand, is the zoom lens. It’s a specific, focused part of your market research that zeroes in on the other players in your space. It answers the question, "How are other companies trying to give people what they want?"

One informs the other. Strong market research tells you where to play, while sharp competitor analysis tells you how to win.

Ready to turn insights into action and outrank your competition? The rebelgrowth platform gives you all the tools you need, from AI-powered content creation to backlink exchanges. Start growing smarter by visiting https://rebelgrowth.com today.